If growth feels harder than it used to, you’re not imagining it. Customer attention is fragmented across devices, trust is fragile, and privacy norms keep shifting. The companies that still pull ahead aren’t just “data-driven”, they’re insight-driven. They translate human understanding into product bets, brand stories, and experiences that compound over time.

What “consumer insights” really are (and aren’t)

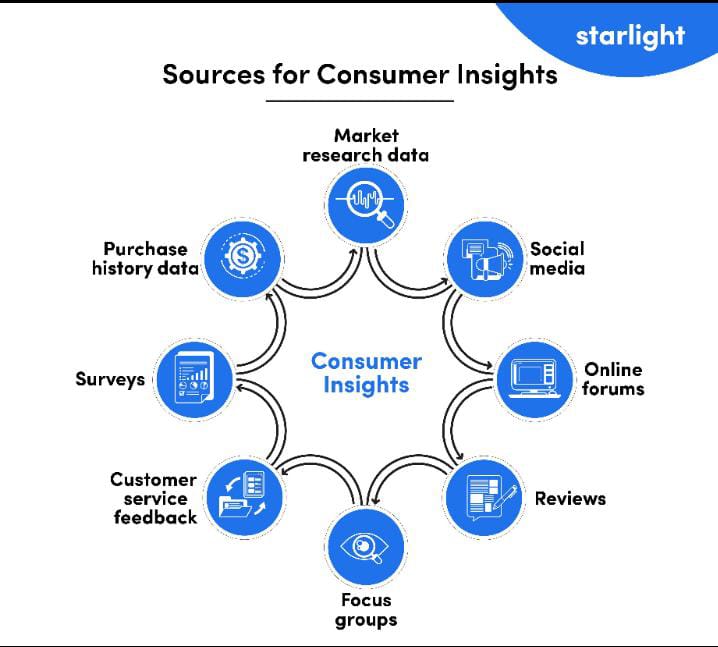

Consumer insights aren’t raw data points or dashboards. They’re interpreted truths about people’s needs, contexts, and trade-offs that change what you do next—what you build, how you price it, where you show up, and how you serve. Insights synthesise what people say, what they do, and what the environment allows (channels, tech, regulation).

A useful litmus test: if an “insight” doesn’t alter a decision, it’s just an observation.

Why insights matter more in 2025

Two macro shifts make insight discipline non-negotiable:

- Behaviour is moving quickly. McKinsey’s 2025 State of the Consumer shows behaviour and sentiment continue to evolve post-pandemic across 18 major markets—what people value, where they spend time, and who they trust. A strategy that assumes last year’s customer is today’s customer risks decay-by-complacency.

- Attention is finite and fragmented. Deloitte’s Digital Media Trends 2025 notes that social video and creator platforms are now a dominant centre of gravity for entertainment and discovery. You’re competing across a six-hour daily media diet that mixes streaming, social, gaming, and audio—so relevance has to be earned, fast.

The privacy reality: build on consented data

If you’ve relied on third-party cookies to understand or target customers, the ground has shifted. Google’s Privacy Sandbox timeline and controls continued to evolve in 2025, with Chrome rolling out changes and grace-period mechanics that signal a long-term reduction in easy third-party tracking. Translation: move from borrowed data to consented relationships.

That’s where first-party and zero-party data come in. Forrester popularised zero-party data as information customers intentionally share preferences, intents, and context in exchange for value (like better recommendations or perks). Brands using this well deliver more relevant experiences without creeping people out.

An insight engine you can run every quarter

Here’s a pragmatic operating model that scales from startup to enterprise:

- Frame the decisions. Don’t boil the ocean. Clarify which choices insights must inform this quarter (e.g., new pricing tier, packaging change, entry into a new segment).

- Triangulate signals. Behavioural – product usage, cart funnels, heatmaps, search queries, support logs. Attitudinal – interviews, surveys, review mining, social listening. Contextual – channel shifts, regulatory updates, and economic sentiment by market. You’re looking for converging evidence, not perfection.

- Turn findings into jobs-to-be-done. Express insights as the customer’s “job,” the struggle, the workaround, and the success metric. Example: “When first setting up payroll, new owners want a risk-free first run more than advanced features.”

- Prioritise by impact × confidence. Score each potential move. Run the cheap, high-impact experiments first (copy, offer, onboarding flow). Park the expensive, low-confidence bets.

- Close the loop. Closed-loop feedback programs such as NPS verbatims tied to actual accounts, with owners who fix issues, are associated with higher growth and profitability when executed systematically.

- Codify and share. Put insight “nuggets” (one-pager: context, signal, decision, outcome) where product, marketing, sales, and service can find them. Insights hidden in slide decks don’t compound.

Where to find leverage right now

- Acquisition: Map competitor content and queries where you almost rank, then ship authoritative resources that answer the whole job, not just keywords. Pair with a targeted offer that reflects the insight (e.g., “risk-free first run” onboarding).

- Activation: Replace generic welcome flows with preference capture moments—two or three questions customers want to answer because the pay-off is immediate (setup shortcuts, tailored bundles). That’s zero-party data done right.

- Retention: Instrument “moments that matter” (first value, renewal, first support ticket). Use win/loss and churn interviews to identify value gaps; then test changes and re-measure within one quarter.

- Channel mix: Given attention shifts to social/UGC, validate which creators actually drive qualified traffic in your category. Expect creative fatigue to rise faster; build a small, always-on testing factory.

Tooling that punches above its weight

You don’t need an army, but you do need a stack:

- Voice of Customer: survey + interview + review-mining (structured coding of themes).

- Product analytics & experimentation: to quantify friction and validate changes.

- CDP or lightweight data hub: to unify first-party data with consent records.

- Consent & privacy ops: to keep your insight engine compliant as Chrome and regulators keep evolving the rules.

Guardrails for ethical, effective insight work

- Ask only what you’ll use. Respect attention as much as privacy.

- Be transparent about value exchange. “Tell us your preferences; get faster setup and fewer irrelevant emails.”

- Design for inclusivity. Check that your samples represent the customers you want, not just the ones easiest to reach.

- Validate in the wild. Real behaviour beats hypothetical intent; A/B tests and pilots keep you honest.

In conclusion, sustainable growth isn’t about hoarding more data; it’s about earning better data and converting it into decisions that customers feel. In a world of shifting behaviours, tighter privacy, and noisier channels, consumer insights are your compounding advantage.