Competition isn’t a threat, it’s a cheat code. For small and medium enterprises (SMEs), disciplined competitive analysis converts guesswork into ammunition; better product decisions, sharper messaging, smarter pricing, and earlier detection of risks and opportunities. Written in this article is a practical, strategy-first guide to making competitive intelligence (CI) an engine of growth for your business.

So, what really is competitive analysis, and why does it matter?

Competitive analysis (also known as competitive intelligence) is the systematic gathering and interpretation of competitor, customer, and market data to inform decisions made legally and ethically. When done right, it moves you from reacting to rivals to anticipating them. Ongoing monitoring, not a single report, is what separates tactical noise from strategic insight.

Why SMEs should care (the payoff)

SMEs gain disproportionate value from CI because they usually have less margin for error and a greater need to prioritise resource allocation. Studies show that CI practices help small firms build dynamic capabilities. This means they adapt and learn faster in shifting markets. Practically, CI helps you: spot product or service gaps, benchmark performance, reduce costly missteps, and win customers by being precisely relevant.

Think deeper, move beyond “who’s copying what”

Competitive analysis is not a checklist of URLs. The most strategic teams treat it as an intelligence pipeline that informs three things simultaneously: positioning (how you talk about value), product (what you build and why), and operations (where to invest or cut). For example, rather than simply tracking competitors’ prices, map the trade-offs customers accept at each price point (features, support, onboarding friction). That leads to pricing experiments that are defensible and profitable.

A practical six-step playbook for SMEs

- Define your competitive set. Include direct rivals, substitute offerings, and potential new entrants. Don’t forget non-traditional players (platforms, marketplaces).

- Collect the right signals. Combine hard metrics (traffic, keywords, funding, pricing) with soft signals (customer reviews, social sentiment, product screenshots, job postings). Tools like SEMrush, Ahrefs, SimilarWeb and BuiltWith make the “hard” data accessible.

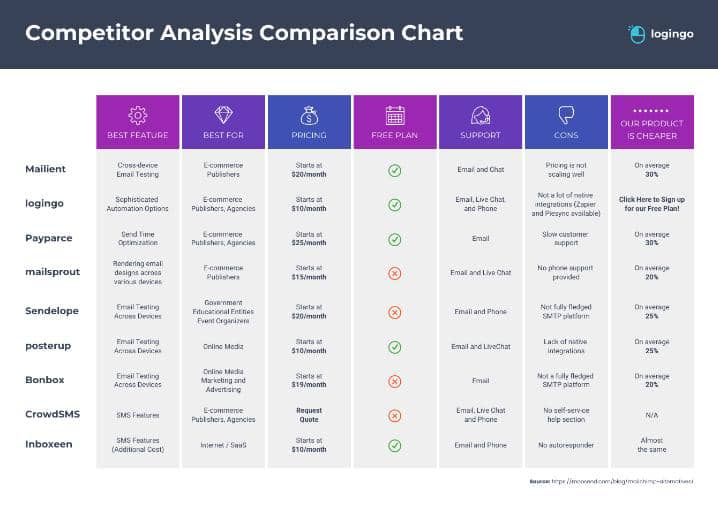

- Use structured frameworks. Porter’s Five Forces, SWOT, and a competitive-analysis matrix turn noise into informed decisions, such as whether to address a feature gap or pivot messaging.

- Prioritise by impact and effort. Score insights against revenue impact, speed to implement, and differentiation potential. Execute the high-impact, low-effort items first.

- Operationalise and test. Turn insights into experiments: A/B test messaging; pilot a new onboarding flow; trial a pricing tier: measure, iterate, and document learnings.

- Automate monitoring and govern ethics. Set alerts for competitor moves and use dashboards for weekly reviews, but stay within legal/ethical boundaries when collecting intelligence.

Tactics that deliver quick wins

SEO & content gaps: Run competitor keyword reports to find “low-hanging” topics they rank for but you don’t; produce focused content to win top-of-funnel traffic.

Win/loss interviews: Ask recent customers why they chose you or a rival — insights here often beat any tool data for conversion improvements.

Pricing reconnaissance: Track offers, discounts, and contract terms. Simple changes to packaging or onboarding can increase conversions without heavy R&D.

Tech stack signals: Use tools to see which platforms or integrations rivals use, such as a clue to their roadmap or partner strategy.

The modern edge with AI and automation

AI is making CI cheaper and faster. From summarising review sentiment to surfacing emerging product features, AI tools help SMEs scale intelligence that once required larger teams. This doesn’t replace judgment; it accelerates it. Early adopters report tangible efficiency and strategy gains.

Common pitfalls (so you avoid them)

Data overload: Don’t collect everything. Define the decisions you need to make, then collect only the signals that prove or disprove your assumptions.

Paralysis by benchmarking: Benchmarks guide, but your market context — customers, margins, distribution — must shape the final call.

Ignoring ethics and legality: CI must be ethical and compliant; avoid deceptive practices and respect privacy.

How to measure success

Track leading and lagging indicators: speed of product iterations, conversion lifts from messaging tests, churn reduction after feature changes, and win rates versus targeted competitors. Over time, map performance against how many high-impact decisions were informed by CI.

In short, make intelligence a muscle, not a report.

Competitive analysis gives SMEs an actionable lens on the marketplace. The real advantage isn’t knowing what competitors did last month, it’s translating intelligence into faster learning loops and better choices. Start small, instrument results, and turn CI into a routine; it will compound faster than most one-off growth hacks.